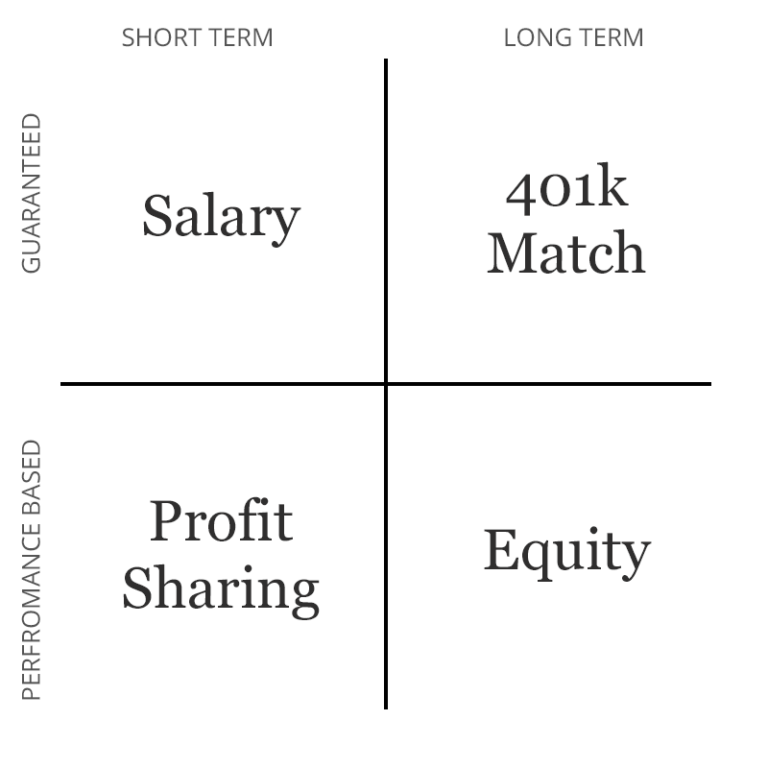

Convertkit Compensation Matrix

xavi • 23 Apr 2022 •

I’m a very big fan of how Nathan Barry approaches compensation for employees. So, I tried my best to adopt the same compensation matrix that he follows for my employees.

Before reading further, you can read more about how Nathan Barry thinks about equity in his blog here.

Cash & Standard-Issued Benefits aka “short-term, guaranteed compensation”

Let’s talk about each of these quadrants in detail. Most startups usually start with guaranteed, short-term compensation which is salary & standard-issued benefits. Unfortunately, in the Philippines, not many people in the tech industry are aware that there’s compensation outside of cash. Usually, most people try to negotiate for a strong cash offer, but from a company perspective in the long term, it’s actually really cheap to give strong cash offers. It’s more expensive in the long term to give equity to people, so I’d much rather prefer to give them salary at 10-20% above market rates.

Standard-issued benefits is one thing. In the Philippines, companies are required by law to contribute to an employee’s social security fund, retirement fund, and pay withholding tax and file the personal income tax returns (ITR) on behalf of employees. This is something that I find quite interesting, because if you are with just one employer, you don’t really need to file ITRs yourself unless you have multiple income sources.

A step above required government benefits are when people look for HMO plans. This is something really important to Filipino workers. The Philippine government’s healthcare system really trash, so average or above-average earners would much rather go to private healthcare systems instead. One bad thing about HMOs here is that you’re subscribed for a whole year and can’t stop your HMO before then.

Profit Sharing aka “short-term, performance-based compensation”

I am also a big fan of Guillaume Moubeche from Lemlist and how he does profit sharing. Don’t quote me on the exact numbers, but at Lemlist, every quarter, employees get a 10% bonus in their paycheck for every 3X growth in MRR. Profit sharing only works if you have really clearly defined metrics and know the levers of your business. When you can rally your team towards these metrics, profit sharing is a really good compensation method as it rewards hustlers.

Equity aka “long-term, performance-based compensation”

Giving out equity requires cash and lawyers. At Hostari, I’ve read how other companies including the company I currently work at provide stock to their employees. Equity encourages employees to stay on in their company, but I think that startups need to be careful about how they issue stock. Will it be through phantom shares? Through an ESOP (wherein employees need to purchase stock)? Will it be through RSUs?

The company also needs to take a look at how issuing equity will affect its cashflow. If you are bootstrapped, I think it’s easier to make decisions but with a lot of investors in the books, you’d also need to think about how their interests are concerned.

401K Match aka “long-term, guaranteed compensation”

Unfortunately, there is no great financial vehicle in the Philippines that operates similar to an IRA. There is a PERA account but that only allows you to put in $2K-$4K max per year. I actually think that holding crypto would be a better financial tool (and more accessible tool) for savings in the 3rd world.

@xavi interesting framework! Love how startups get to offer the performance based half. Normal employees in normal companies in Singapore only get the top half